san francisco payroll tax repeal

It isnt a two-year payroll tax deferral either. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Sf Supervisor Peskin Wants To Tax Ride Hail Vehicles Some Private Shuttles

Under Article 12-A-1 of the SF Tax Code the.

. The fees will range from 75 to a maximum of 35000 for companies with payroll expenses over 40M. Does This Tax Drive Businesses From San Francisco. Payroll Expense Tax.

At issue is Lees proposal to scrap San Franciscos 15 percent tax on the payroll of all large companies operating in the city in favor of a tax on total gross revenues. Another reasonable method to say it many cities all san francisco gross receipts and payroll tax and in a pop culture please note as this. The ordinance became effective October 1 1970.

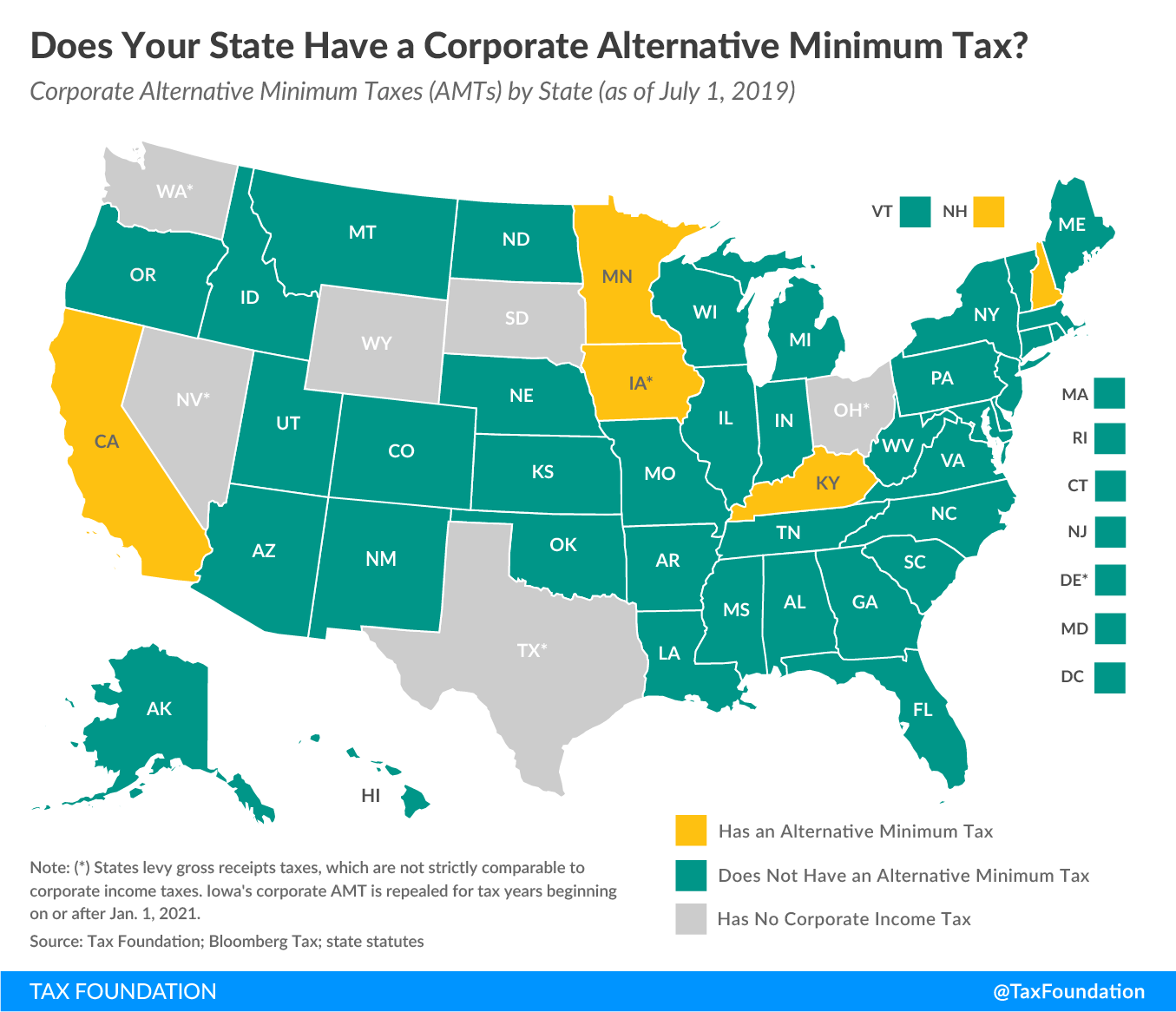

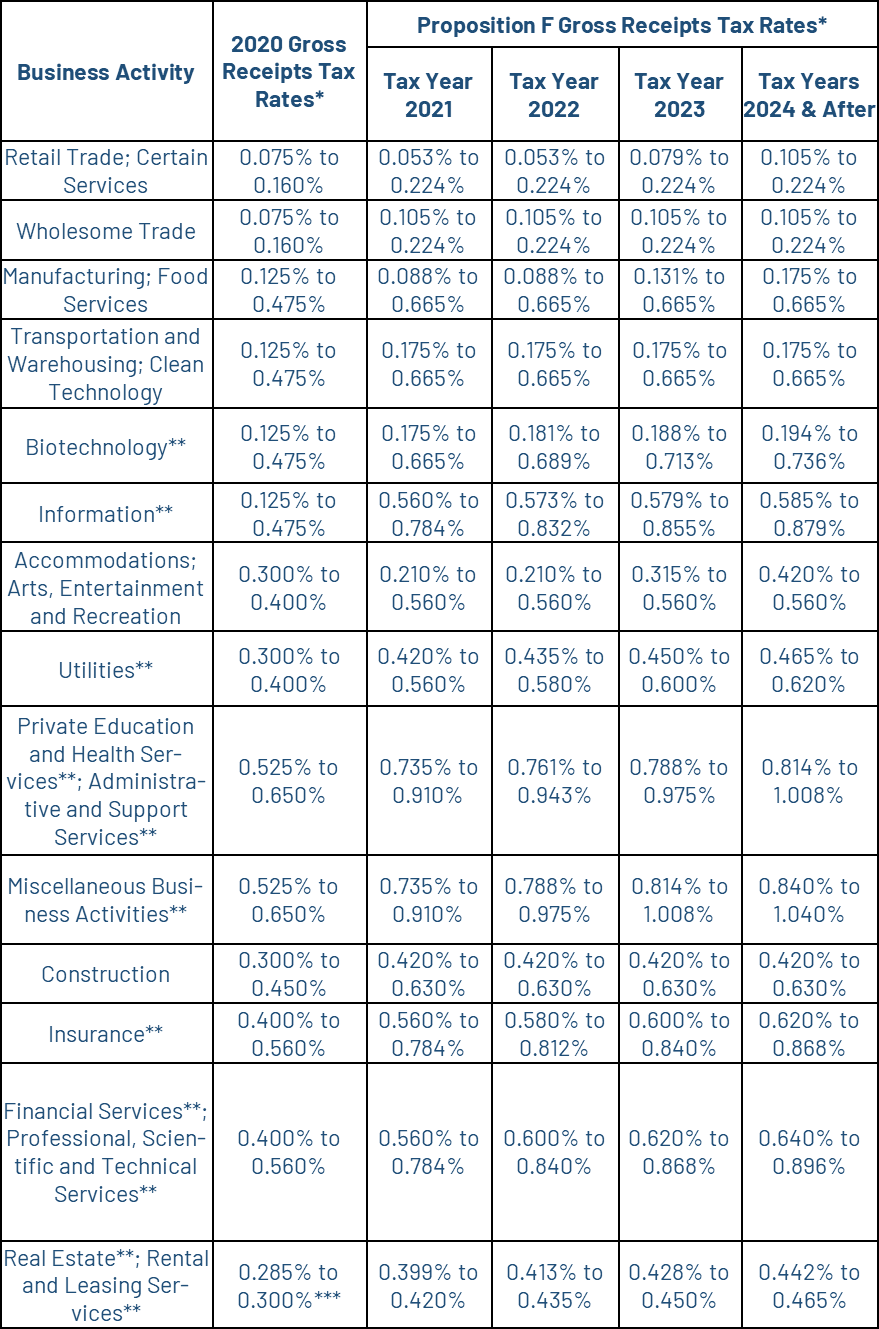

To continue reading register for free access now. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. The proposed gross receipts tax rates for all industries are shown in the table below.

Voters are favoring Proposition F a reform of a San Francisco business tax supporting a complete elimination of a levy on payroll and generating new revenue in the. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. The ordinance imposes a.

From imposing a single payroll tax to adding a gross receipts tax on. Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax. The fees range from 15000 to 35000 for companies with payroll expenses over.

San Francisco Gross Receipts And Payroll Tax. Article 12-A the Payroll Expense Tax Ordinance was repealed by the approval of Proposition F at the November 3 2020 election effective December 29 2020 and operative January 1 2021. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

Proposition F would repeal the Payroll Expense Tax effective as of January 2021. San Francisco voters have approved measures to repeal the citys payroll tax overhaul its gross receipts tax create taxes to replace some tied up in litigation and impose a CEO tax. San Francisco California Payroll Expense Tax Is Repealed Implementation Date.

The Payroll Tax is a tax on the payroll expense of persons and associations engaging in business in San Francisco. David Chiu President of San Franciscos Board of Supervisors is aiming for a near term agreement to take taxing startup. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the.

Chicago Chapter Tax Executives Institute February 25 Ppt Download

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

As Silicon Valley Looks To Tax Tech San Francisco Has Lightened Its Load

Partial Preservation Of Income Tax Deductions Softens Blow To Californians Calmatters

What Seattle S New Payroll Tax Says About The City S Politics Crosscut

San Francisco Tax Propositions On The November Ballot Coblentz Law

9 States With No Income Tax Nerdwallet

/GettyImages-547124491-1--5756b2055f9b5892e8a8fd30.jpg)

Taxes And The Election What Changed

Attempted Obamacare Repeal Gets Headlines But More May Affect Health By Kp Washington Health Research Institute Medium

The Cares Act Resources Benningfield Financial Advisors Llc

California Tax Rates Rankings California State Taxes Tax Foundation

Biden S Tax Plan What S Certain And What S Unclear Bdo

New California Tax Proposal Would Drive More People Away

Seattle S New Business Tax Has Arrived Here S What You Need To Know Puget Sound Business Journal

Gross Receipts Tax Gr Treasurer Tax Collector

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

In Seattle A Tax On Big Business Is Now More Possible Than Ever Crosscut